KNUSTSpace

Institutional Repository of the Kwame Nkrumah University of Science and Technology

On this portal we showcase the intellectual output of the university..

Communities in DSpace

Select a community to browse its collections.

Now showing 1 - 5 of 7

Conference Proceedings This Community features the proceedings of conferences hosted by the KNUST or other bodies but had staff from KNUST attending and making presentationsJournal of Science and Technology (JUST) Research Articles from the members of KNUST submitted to the JUSTKumasi Center for Collaborative Research (KCCR) Lectures **Lectures** are structured presentations or talks delivered by an instructor, professor, or expert to convey knowledge on a specific subject.Research Articles

Recent Submissions

Item

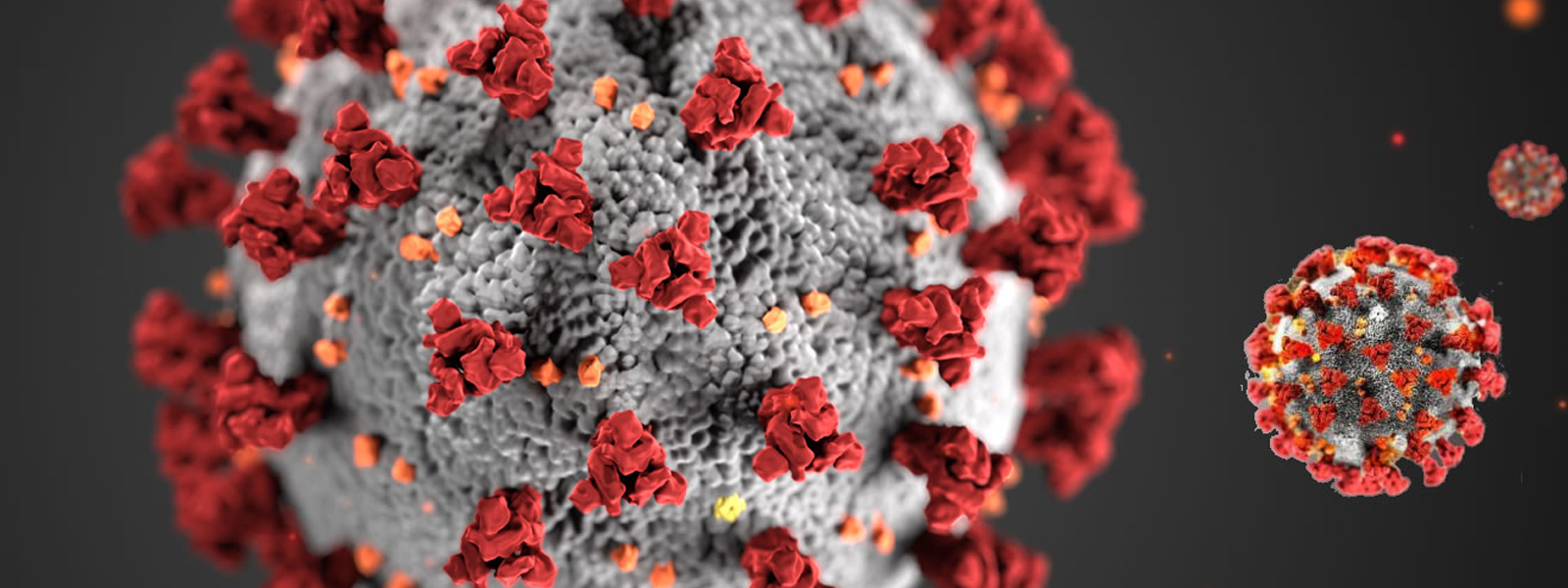

Quasi-state of emergency: assessing the constitutionality of Ghana’s legislative response to Covid-19

(KNUST., 2020-06-15) Addadzi-Koom, Maame Efua

On 15 March 2020, the President of the Republic of Ghana addressed the nation

on anti-coronavirus measures which took effect immediately. He directed the

Attorney-General to submit an emergency legislation to Parliament and the

Minister for Health to issue an immediate Executive Instrument to regulate

the relevant measures. Five days later, Parliament passed the Imposition of

Restrictions Act, 2020 (IRA) after a voice count in its favour. A few days,

thereafter, the President issued an Executive Instrument (E.I. 64) pursuant to

the IRA. The minority members of Parliament, some legal scholars and

interested Ghanaians expressed their disapproval of the procedures leading to

the enactment of the IRA as well as its nature, form and content. The

contentions cover multiple constitutional and legal grounds including the

procedural propriety of using a voice vote in Parliament for emergency

legislation, the necessity of a new emergency legislation and the time limit for

the new emergency legislation. Essentially, these issues point to assessing the

overall constitutionality of the law-making procedures and legislative

provisions of the IRA. This is the focus of this paper. The paper argues that

the IRA stands unconstitutional from the very beginning of its intended

existence. The paper concludes that while the IRA is currently operational, its

continued existence is challengeable under the 1992 Con

Item

APPLICATION OF QUEUING THEORY IN THE EFFECTIVE MANAGEMENT OF TIME IN MONEY DEPOSIT BANKS-A STUDY OF GHANA COMMERCIAL BANK IN OBUASI MUNICIPAL

(KNUST, 2019-05-22) Fiele Abudu Suleman

Waiting for services is a phenomenon in Ghana. We wait to eat in restaurants,

we queue to board buses, we line up for service in post o_ce and in banks either

to deposit or withdraw money. The waiting phenomenon is not an experience

limited to human beings only but objects too. Jobs wait to be processed on a

machine, planes circle in stack before getting permission to land at an airport

and cars stop at traffic lights waiting for their turn. Waiting cannot be elimi-

nated entirely without incurring inordinate expenses and the goal is to reduce its

adverse impact to a tolerable levels.

The objective of this study is to use already available systems to identify and

also make known the effects and rami_cations of keeping customers waiting in

the queue and also the cost banks had to bear if idle facilities are not put into

good use, with special emphasis on Obuasi branch of GCB. The queuing char-

acteristics at the bank were analyzed using a Multi-server single-queue Model to

achieve this major objective. Data for this study was collected by direct obser-

vation with the help of research assistants, a stop watch to record the number

of hours/minutes spent by each customer at the bank. The data collected from

the bank showed that 28th of June, from an hour of 9:30am-10:30am recorded

the highest number of customers in the waiting line(113) whiles the least num-

ber of customers (17) in the waiting line was recorded on 18th of July hour of

9:00am-10:00am. customers had to wait an average of 0.0165 hours in the queue

and 0.0183 hours in the system before leaving the bank.

We _nally suggested that, queuing theory is worth studying; the _ndings of it

can be used by managers of banks to determine and install the optimum service

facilities or in other words put in place the appropriate technologies to help deal

with long queues in their banks.

Item

Effect of traditional processing of hausa koko (millet porridge) and ekoegbeme (cooked dehulled maize grits) on aflatoxins.

(KNUST, 2019-06) Ankomah, Albert

Aflatoxin is produced as secondary metabolites by fungi Aspergillus flavus, A.parasiticus and A. nominusmoulds. These fungi grow on various crop such as nuts, maize, millet and other grains. Chronic dietary ingestion of low dose of aflatoxin is a risk factor for liver cancer, however ingestion of high doses of aflatoxin contaminated food can result in aflatoxicosis with symptoms including vomiting, abdominal pains and jaundice. This study was aimed at investigating the effect of traditional processes of Hausa koko (millet porridge) and “ekoegbeme" (cooked dehulled maize grit) on aflatoxin. The level of aflatoxin G1, G2, B1, B2 and total aflatoxins were measured at the end of the various processing stages of each food product by HPLC method. The processing stage that produced significant reduction was identified by using ANOVA. Overall, processing of “ekoegbeme” resulted in more aflatoxin B1 and total aflatoxin reduction than the processes involved in preparing Hausa koko. Fermentation of millet during Hausa koko processing resulted in 13.97 % and 4.82 % reduction in aflatoxin B2 and B1 respectively with total aflatoxin reduction of 4.9% while cooking of the fermented filtrate to Hausa koko resulted in 0.70 % and 1.85 % reduction in aflatoxin B2 and B1 respectively as well as 1.49 % reduction in total aflatoxin. However the steeping of the millet caused an increase of 11.88% and 7.67% in the aflatoxin B1 and total aflatoxin respectively. The dehulling of the maize during preparation of ekoegbeme resulted in 100% reduction in aflatoxins while cooking of the maize resulted in 11.52 % reduction in total aflatoxin as well as 5.95 %, 3.97 %, 41.53 % reduction in aflatoxin B1, B2 and G1 respectively. There was no aflatoxin G2 detected in the maize and millet samples used for the investigations.

Item

Akan Religio-Cultural Thought and Environmental Management: The Case of the Atiwa District, Ghana

(KNUST, 2018-11) Antwi, Joseph Kofi Rev

There are a number of academic studies that suggest that conservational values embedded in religio-cultural thoughts could be used in collaboration with science in finding lasting solutions to the environmental problems. However, despite these abundant studies and advocacy, successive governments of Ghana have ignored these in environmental management strategies. Using the Atiwa district in the Eastern Region of Ghana, as a case study, this study explores the reasons why policy-decision makers have not factored the Akan religio-cultural thoughts into environmental management in Ghana. Three qualitative techniques were employed in this study: key-informant personal interviews, participant’s observation and focus-group discussion. Data from the fieldwork were analysed to discover relationships, facts and assumptions that addressed the objectives of the study using the ethnographic research analysis tool. The study reveals that Akan religio-cultural thought comprises primarily the thinking patterns, values, beliefs and practices of the indigenous people and expressed through myths, customs, traditions, proverbs, beliefs and practices, values and moral systems, and they continue to shape the life of the people, including their ecological knowledge. The study further shows that Akans express their environmental conservational potentials through indigenous resources such as the concept of Kraboa (Totems), Sasa-tumi (Spirits), Sacred groves, Gyedua (Trees), Asaase Yaa (Mother Earth), and others. The study notes that the people have been relying on these conservational strategies since time immemorial, long before the encounter with Westernisation. To be able to harness their conservational potentials today, it is proposed that the religio-cultural thoughts must be ennobled to serve as a guide to environmental managers in formulating new policies of conserving the environment not only in Atiwa, but other communities in Ghana.

Item

Virtualization of knust’s tangible heritage: an Alternative medium to enhance access

(KNUST, 2020-11) Asiamah, Kwabena Ofori

Indisputably, museums provide research, educational and recreational benefits to

mankind. This has been carried out manually for centuries. But with the emergence,

and spread of Information Communication Technologies (ICT’s) this manual services

are changing rapidly to virtual services; all because the current generation of students

and researchers alike unconsciously resonate towards electronic platforms to access and

utilize information. Not very mindful of this, Kwame Nkrumah University of Science

and Technology attempted to establish a brick and mortar museum between 2002 -2012

to showcase her heritage but to no avail. Meanwhile huge sums of money, technical and

managerial resources had gone into it. In order to salvage such investment and to be

able to enjoy the benefits inherent in museum services, the idea of a virtual museum

was hatched as an alternative medium to achieve the same goals. The study therefore,

analyzed museum services in Kwame Nkrumah University of Science and Technology

(KNUST), designed, developed and implemented a demonstration virtual museum

(Virtual Museum of KNUST– (VIMU KNUST) and finally evaluated the effectiveness

and efficiency of VIMU KNUST in enhancing access to KNUST’s tangible Heritage. In

advocating for the creation of such a resource, the Sequential Exploratory Design in

(mixed method) was employed. Questionnaires, interviews, documentary reviews and

observation were used to gather data. Initial assessment results were reinforced by a

subsequent survey in order to be sure of the preference of the virtual museum by the

University. Additionally, a demonstration virtual museum was designed for evaluation

and the evaluated opinions were used to refine it for implementation. Analysis of Data

revealed that, apart from access enhancement of Kwame Nkrumah University of

Science and Technology’s (KNUST) heritage by the Virtual Museum (VIMU

KNUST), it will also provide monetary, visibility and educational benefits. More so, it

became evident that the preference of the university community was on a virtual

museum where patrons could sit anywhere and access it via the internet. As a sequel to

these, the study recommended among others that the University Management

Committee prioritizes the creation of a virtual museum as needed by the University

community while ensuring that, the resource is well advertised and that the interactivity

as well as navigability features of the resource is up to task.

Item

Health and safety knowledge transfer and diffusion From the construction industry to the community as a Corporate social responsibility

(KNUST, 2020-06) Williams, Justice

Clear evidences have shown that poor state of health and safety cultural practices have

existed among Ghanaian citizenry. This has created much debate among government,

academics, religious bodies, opinion leaders and the media, thereby calling for

immediate action to improve the situation. Reports from some national institutions

like The National Statistical Service Report, (2016) and the Ghana National Fire

Service Incident Report, (2016) have pointed out the urgent need to improve the state

of Health and safety in the country. The reports have acknowledged that ignorance

and negligence rank high as causes of most health and safety problems reported in the

country. In recent years, awareness of Health and safety in the construction industry

has increased. Meanwhile, these construction companies operate in the communities

and are socially expected to go beyond the execution of their projects and engage in

corporate social responsibility (CSR) as a give back to society. However, contractors

complain about several factors that affect their ability to fulfil this expectation.

Therefore, the aim of this study is to develop a framework for the transfer of health

and safety knowledge and its diffusion into Ghanaian communities by construction

companies as a corporate social responsibility. In order to facilitate the understanding

of the processes of transferring knowledge from a construction company to the

Ghanaian communities, two theories were integrated: innovation diffusion theory and

knowledge transfer and conversion theory. Through a questionnaire survey and

semistructured face-to-face interviews, both quantitative and qualitative data were

collected from road and building contractors of all classes across the country. The data

were analysed using chi-square test of independence, one sample t-test, cumulative

scale analysis and factor analysis for the quantitative data while thematic analysis was

used for the qualitative data. Findings from both the quantitative and qualitative

studies confirmed the improvement of health and safety knowledge in the Ghanaian

construction industry. The study found that road contractors are better performers in

Health and safety than building contractors. Furthermore, the study established that

the maturity of health and safety culture in the Ghanaian construction industry is at its

first stage of the health and safety culture maturity ladder. The study further found six

major challenges confronted by Ghanaian contractors engaged in corporate social

responsibility. Topmost among these are the view that Ghanaian contractors have of

i

v

CSR as avoidable expense, the absence of a legal framework to guide CSR

implementation and lack of incorporation of CSR into the Vision and Mission

Statements of organisations. The study also identified five knowledge transfer

enablers and four barriers to knowledge transfer from the Ghanaian construction firms

to the communities. Six enablers were also found to be significant in diffusion of

knowledge in the Ghanaian communities by contractors with four associated barriers.

The findings from the study resulted in the development of stage by stage knowledge

transfer and diffusion framework for facilitating transfer of knowledge and its

subsequent diffusion from construction companies to the communities as a corporate

social responsibility to construction companies. The study contributed immensely to

the academia where it tests, extends and integrates innovation diffusion theory and

Nonaka and Takeuchi’s knowledge conversion and transfer theory to a new context

thereby helping to better explain external knowledge transfer and diffusion from the

construction company to the community. Practically, the dynamic factors in

integrating innovation decision processes, knowledge transfer and conversion

processes, knowledge transfer influencers and complexities and knowledge diffusion

influencers and complexities would assist researchers to understand external

knowledge transfer from the perspectives of construction companies to the

communities. Further, the framework proposed provides a practical step towards

actions and activities required to be institutionalised to enhance the transfer process.

Therefore, the findings of this study can be used as a practical guide for construction

companies to transfer knowledge from the industry to any community in which they

find themselves.

Item

Adaptive selection and behavioural conditioning framework for the attitudinal change of construction workers towards the use of safety helmets and goggles

(KNUST, 2020-10) Adade-Boateng, Anita Odame

Construction workers are constantly faced with several hazards due to the nature of their work

environment. Head traumas and eye injuries on construction sites are of great concern to

industry stakeholders in the efforts to improve health and safety performance of the

construction industry. Like most PPE, Safety helmets and goggles are a statutory requirement

in most countries to protect the head and face regions which are the most vulnerable in the

event of an accident. Safety helmets protect the head against the impact of lateral objects or

the impact of falling objects on construction sites. Similarly, safety goggles protect the eyes

and the face region from severe injury from flying particles and or other hazards encountered

during construction work when used appropriately. Despite their importance, construction

workers are reluctant to use safety helmets and goggles due to several discomforts experienced

and thus are continuously faced with exposure to several hazards at the workplace. While using

these PPE may prevent injury and or fatalities on the construction site, providing workers with

poor fitting PPE may introduce other forms of strain that may contribute to avoidable incidents

on site. This research employed a combination of adaptive selection and behavioural

conditioning principles to remedy the discomforts associated with safety helmets and goggles

to improve their use on construction sites. A preliminary investigation was initially conducted

through the personal administration of questionnaires to one hundred and twenty-three (123)

construction operatives to find out why construction workers do not use given PPE. Data for

the main study was obtained through semi-structured interviews and a physiological strain field

experiment (using physiological indicators of heart rates and body temperatures) involving

sixteen (16) male construction workers, a comparative analysis of linear anthropometric head

and face measurements of one hundred and twenty-seven (127) male construction workers and

dimensions of construction helmets and goggles available in Ghana within a multiple case

study. A questionnaire survey of seventy – four (74) large construction firms in the country

was also conducted to identify selection considerations made in the procurement of helmets

and goggles. A content analysis on interviewee data indicated that hotness and poor fit are the

top two discomforts associated with safety helmets while blurred vision and poor fit are

prevalent among safety goggle users. Workers were found to experience little or no

physiological strain while using uncomfortable safety helmets in hot weather, when values of

physiological indicators were entered into a physiological strain equation and interpreted on a

universal scale. A two-sampled T-Test indicated statistically significant differences between

helmet and head dimensions, as well as safety goggles and face measurements. Descriptive

analysis of the likert data indicated that construction firms consider several factors aimed at ensuring the procurement of comfortable safety helmets and goggles. The study recommends

a behaviour-based framework with a three – tier intervention plan, that combines a selection

criteria consisting of anthropometric characteristics, ambient temperature, consideration of

standards (aimed at improving the comfort experience of users), with activities such as user-

involvement in the procurement process, safety inductions with audio-visuals, participatory

toolbox meetings and selection of safety champions to stimulate the preferred behaviour of

appropriate use of the PPEs. The conditioning theory is then applied in Tier three of the

framework to maintain the acceptable behaviour. The proposed framework is intended to

ensure the procurement of comfortable safety helmets and goggles for construction work and

simultaneously improve the attitude of workers towards these PPE.